Fubo TV Throws Flag on Football Streaming

August 11, 2022

Arkansas Razorbacks Season Wins Total Odds & Prediction

August 15, 2022Sportsbooks such as BetRivers and PointsBet are prepping for football season, and future market interest is increasing now that college and pro camps are open.

After a bad slump for much of the year, there are indications that a host of beaten-down sports betting stocks may have finally hit bottom and are poised for a rebound. Some of the top industry names, many of which maintained market capitalizations above $20 billion a year ago, showed signs of recovery in July.

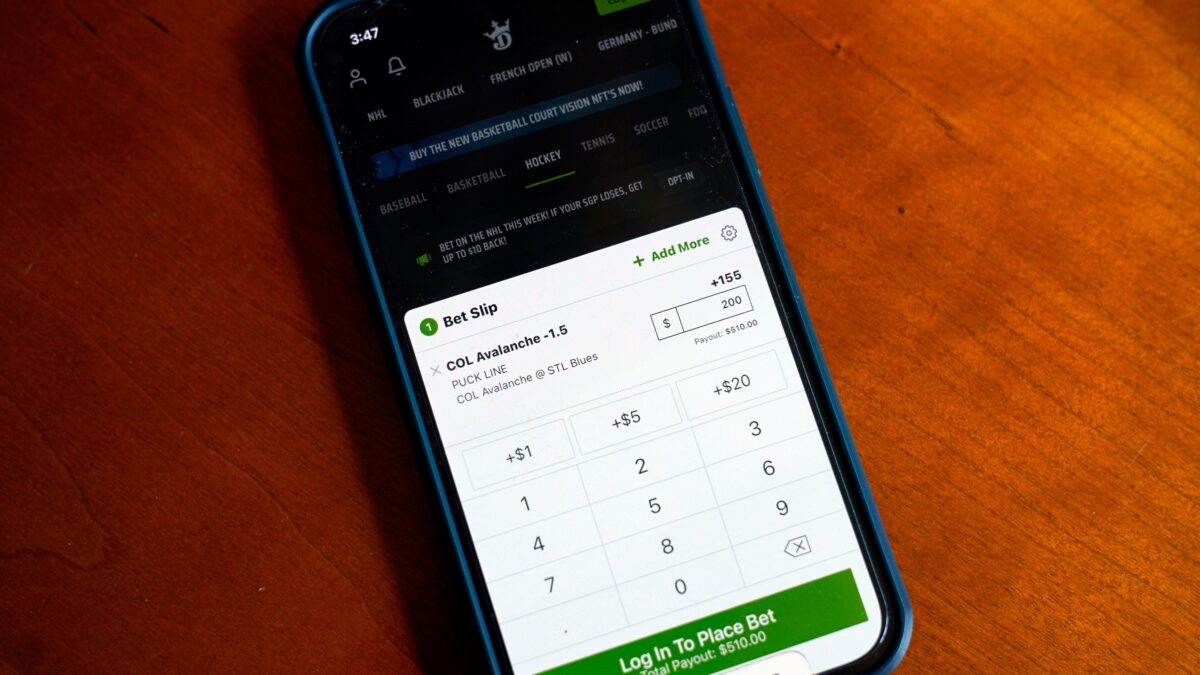

DraftKings, which dipped below $10 a share in May, surged more than 15% in July, producing only its third positive month over the last year. Over that span, DraftKings’ stock plunged more than 70%, wiping billions of dollars from its market cap. Two traditional Las Vegas powers, MGM Resorts and Caesars Entertainment, also increased in July, each gaining more than 14% for the month.

Sports betting stocks have endured a horrendous 10-month period, battered by runaway inflation and skepticism that top companies can deliver long-term profitability. The projected time frame for the companies to break even has been a major topic of discussion on 2022 second-quarter earnings calls. Caesars and BetMGM lost more than $65 million in the quarter from online gaming, fueling detractors who argue that digital sports betting is too costly.

Typically, marketing costs for top sportsbook operators drop in the early portions of the second half due to a quiet summer sports calendar. During Caesars’ earnings call, Reeg indicated that he expects marketing efforts to pick up again as the start of football season nears.

Gaming equities analysts will receive further insight into acquisition trends across the industry Friday when DraftKings reports second-quarter earnings. DraftKings is expected to post revenue of $438.2 million for the period, a massive increase of 47.3% from the same quarter in 2021.

Analysts are more focused on the company’s earnings metrics, where DraftKings is expected to report a second-quarter loss of $0.87 per share, a decline of 14.5% from last year’s Q2. In that quarter, DraftKings incurred sales and marketing expenses of $171 million.

Ahead of Friday’s call, DraftKings jumped 9% in Wednesday’s session before reaching $17.15 in pre-market trading on Thursday. It marked DraftKings’ highest level since April 19.

DraftKings, which maintains a 105,000-square-foot headquarters in Boston’s Back Bay neighborhood, could be bolstered by the legalization of sports betting in Massachusetts.

Flutter Entertainment, the parent company of FanDuel, is scheduled to report 2022 interim results on Aug. 12. Before the earnings call, FanDuel announced several leadership changes.

Now is the time to check out BetRivers and PointsBet for the latest bonus offers for the upcoming football season!