NFL Sends Mixed Messages on its Betting Policy

April 24, 2023

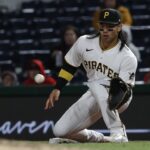

Tuesday, April 25 MLB Best Bets

April 24, 2023Changes are likely coming to Tennessee’s sports betting market.

State legislators, who rapidly pushed through the end of the legislative session this week, passed SB 475. The bill changes the state’s mobile sports betting tax system from a 20% tax of adjusted gross revenue to a 1.85% tax on an operator’s handle.

The bill also removes the state’s controversial mandatory 10-percent hold rule., which sports betting operators were skirting by paying a minuscule fine when failing to meet the threshold. The bill “prohibits licensees from deducting payouts to bettors or promotional wagers or payouts from total gross wagers.”

The handle tax will be the first nationally, assuming Gov. Bill Lee signs SB 475. Additionally, language in the bill removes the state’s official league data mandate. SuperBook Sports and Betly had previously argued to the Sports Wagering Advisory Council that paying Genius Sports for official NFL league data was commercially unreasonable. The SWAC punted the decision to the legislature, which removed the requirement.

Keep in mind that there are special daily offers to check out. April means that the NBA and NHL are in playoff power drive. Tennis, golf, boxing, auto racing, and MMA action are open. So too, is Major League Baseball offering daily action with new rules that have increased interest. And you can get plenty of action on the 2023 NFL Draft that opens on April 27. It’s all underway and coming in hot, with action available now. This is the best time of year for sports betting activity in overdrive. There are daily specials for each day of the week, which is not to be missed. Go to BetRivers for these daily offers!

In the first three months of 2023, Tennessee received $22.4 million in tax revenue from mobile sportsbooks. If the 1.85% handle tax were in place, the state would have received $20.9 million instead.

So far, in the fiscal year 2023, which began last July 1, Tennessee has received $65 million in tax revenue from sports betting. That number would have been $58.1 million when using the 1.85% handle tax, nearly $7 million less. Under the new system, the state could bring in less tax revenue than in previous years.

Tennessee’s top five monthly handles have come in the 2023 fiscal year.

If operators generate massive handles moving forward, the state could receive significant tax revenue in future years. Tennessee may miss out on tax revenue under this new system if handle dips. Before amendments, SB 475 would have taxed the handle at 2% for slightly higher tax revenue generation.

Removing the official league data mandate is a notable change to Tennessee sports betting regulations. Smaller operators may opt to use unofficial data sources as a cost-saving measure.

Go to BetRivers for these daily offers! Now is the time to get the latest bonus offers for all major sports. There are also DAILY SPECIALS to check every day of the week!