Sports Betting Industry Gets Lesson on Data

October 4, 2022

LIV Golf Invitational Thailand Picks

October 5, 2022The jockeying around the online NY sports betting tax rate discussion at next year’s legislature is already underway. New York online sports betting handle fell $33 million from Week 1 of the NFL season to Week 2. Operators combined for $297 million in NY online sports betting handle from Sept. 12-18 after combing for $330 million from Sept. 5-11.

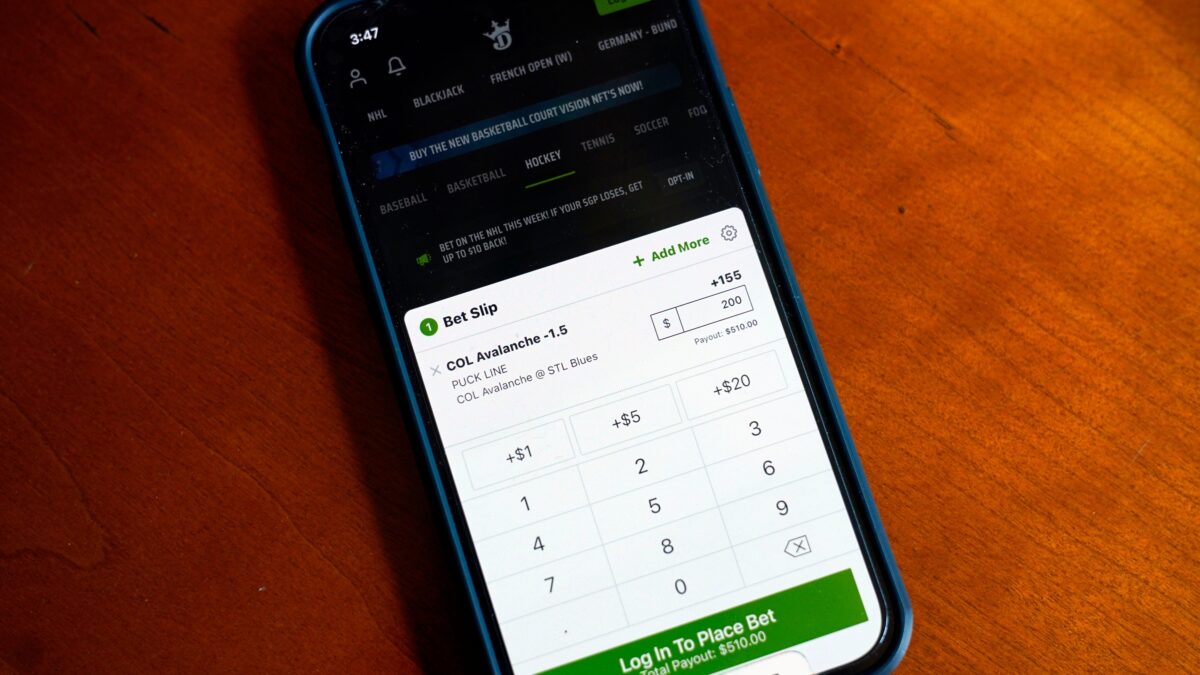

Sportsbooks such as BetRivers are coming in hot for the current 2022 college and pro football season. And the MLB Playoffs and NHL season openers are coming too. Check out their DAILY specials and bonuses today!

New York online sportsbooks amassed nearly $40 million in revenue from Sept. 12-18, though the hold was 13.4%. That is nearly double the national average since the fall of PASPA (7.3%.) Overall, NY online sportsbooks have combined for $11 billion in handle this year (Jan. 8-Sept. 18) with $866 million in gross gaming revenue and $442 million in tax revenue.

While it is early in the 2022 regular season, the first two weeks have yielded far less handle. However, operators were offering significant bonuses during the NY launch. For example, Caesars offered a $3,000 deposit match plus $300 for new customers.

But those offers are no longer available, with many operators cutting back on marketing and promotional spending. They blame the state’s 51% tax rate for hindering their long-term profitability path. Operators were also taxed on their promotional spending. Combined with federal excise tax, Morgan Stanley equated the NY tax rate to 77%.

If the current trend of decline continues, operators could have more ammunition in their never-ending quest to get a tax reduction. Granted, operators knew the tax rate and the lack of promotional deductions when they signed up to do business in the state. So far, as NY has pulled in record tax revenues, their legislative and lobbying efforts at a reduction have been unsuccessful.

The incentives are lacking. When sportsbooks gave incentives, they offered free play and matching play, which were all included in the numbers. However, because they’re subject to this 51% tax, they’re not giving away as much money because they’re paying taxes on their own money. So books will see a decrease in the handle.

If the current trend of decline continues, operators could have more ammunition in their never-ending quest to get a tax reduction. Granted, operators knew the tax rate and the lack of promotional deductions when they signed up to do business in the state. So far, as NY has pulled in record tax revenues, their legislative and lobbying efforts at a reduction have been unsuccessful.

Politicians have repeatedly said they want to revisit NY’s framework later this year. Any potential changes would have to ensure the state does not lose any tax funding for education programs. As per the legislative language, 98% of all tax revenue from NY online sports betting goes to educational funding.

Now is the time to check out BetRivers for the latest bonus offers for the upcoming football season. There are also DAILY SPECIALS to check every day of the week!